MARTIN Lewis has revealed how much more you'll take home this month following a national insurance cut.

Hosting the fourth episode of of his latest series, The Martin Lewis Money Show, the MoneySavingExpert (MSE) founder gave his best tips on saving money this winter.

Throughout the programme, Martin and his co-host Angelica Bell, offered handy hints to help people save money.

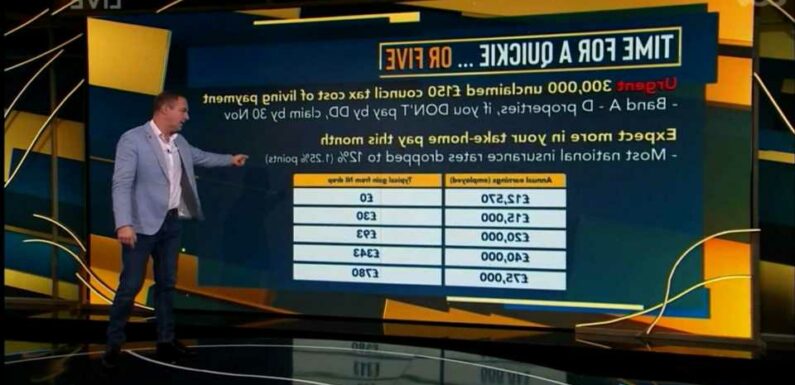

During a very short segment of the programme, the money guru told audience members to expect more in their take-home pay this month.

He encouraged viewers to check how much extra they'll take home thanks to the tax cut.

The reason being is that earlier this week, National Insurance rates dropped meaning millions of Brits will receive a well-earned pay rise.

READ MORE SUN STORIES

What is National Insurance and how much do I pay?

Millions to get £330 a year as National Insurance rise is scrapped in WEEKS

The average worker is set to receive a £330 a year pay boost thanks to a cut in the rate of National Insurance contributions.

Martin said: "Another quick note, National Insurance rates dropped on Sunday to 12% so 1.25 percentage points roughly for most people.

He explained that the change doesn't mean anything for those earning £12,750 a year because they don't pay National Insurance anyway.

National Insurance is paid by employees over the age of 16 and earning above £242 a week.

Most read in Money

Martin Lewis warning over ‘home appliance that’s biggest energy user’

Martin Lewis says 300,000 Brits urgently need to claim £150 – here's how

McDonald’s fans furious over McFlurry change

Greggs reveals Christmas menu including the Festive Bake

However, for those on larger salaries, he added "the more you earn, the bigger the gain".

For example, someone on a £20,000 a year will make a £90 annual gain while a £40,000 a year salary will get an extra £343.

Martin then told viewers to check out how much extra they will get this month following the change.

You can work out how much you'll take home following the scrapping of the NI hike, use MSE's Tax Calculator – of course, just how better off you'll be depends on your salary.

A 1.25 percentage point rise on national insurance was introduced by Boris Johnson’s government, with Rishi Sunak as chancellor,back in April.

The levy was expected to raise around £13 billion a year to fund social care and deal with the NHS backlog which has built up due to the Covid pandemic.

However, this rise was reversed by former Chancellor Kwasi Kwarteng in his infamous mini-budget last month and came into effect from Sunday, November 6.

When announcing the reversal, the Treasury said most employees will receive a cut to their national insurance contribution directly via their employer’s payroll in their November pay.

Its scrapping is one of few economic policies introduced by Liz Truss and Mr Kwarteng that was not axed by Jeremy Hunt.

How much will you save from the National Insurance change?

The exact amount that you will save will depend on how much you earn.

Personal finance specialists at Hargreaves Lansdown have worked out how much people will save based on their earnings.

- Workers on £20,000 will save £93 a year

- Workers on £30,000 will save £218 a year

- Workers on £40,000 will save £343 a year

- Workers on £50,000 will save £468 a year

- Workers on £60,000 will save £593 a year

- Workers on £80,000 will save £843 a year

- Workers on £100,000 will save £1,093 a year

You won't see the cash all at once in your paycheck. Instead, you'll see the amount of tax you pay each month reduced.

What is National Insurance?

National Insurance is a tax on your earnings, which is put into a fund to use for some state benefits.

This includes the state pension, statutory sick pay, maternity leave and unemployment benefits.

If you are a UK national, you should receive an NI number and card automatically before you turn 16.

This number allows the government to track your earnings and apply the right amount of tax.

Who pays National Insurance?

You pay National Insurance if you’re 16 or over and either:

- an employee earning above £242 a week

- self-employed and making a profit of £6,725 or more a year

It is deducted from your wages each month.

If you're employed, you can see your contributions by looking at your pay slip.

Read More on The Sun

We live in one of the coldest places in the world – our tip helps you stay warm

Jobs with the WORST bosses revealed – is yours on the list?

Once you reach state pension age, you don't need to pay it at all.

There are different types of National Insurance – known as "classes" -, and the type you pay depends on your employment status and how much you earn, and whether you have any gaps in your National Insurance record.

Source: Read Full Article