The housing market has returned to earth. Home sellers can't just name a price and expect buyers to pay; meanwhile over a trillion dollars in wealth in the form of home equity has evaporated.

Why it matters: Think of this less as a crash and more as a correction. The pandemic-driven housing boom was a bonkers moment of real estate demand.

- The Federal Reserve raised rates and crushed that demand, as intended.

State of play: During the pandemic boom, houses were selling for more than list price. A "historically unusual" situation, says Nicole Bachaud, senior economist at Zillow.

- Sellers are now accepting less than list prices, on average, to make sales, a return to pre-COVID trends.

- Experts say this is a return to normal in a lot of ways, even though 7% mortgages feel abnormal. "It's a really awkward phase of the market because we're coming off of this pandemic frenzy," says Bachaud.

Meanwhile: A whopping $1.37 trillion in mortgage holder equity vanished in the third quarter, thanks to falling home prices, according to calculations by mortgage technology firm Black Knight.

- It's the sharpest single-quarter decline, by dollar value, since 2000. On a percentage basis, it's the steepest drop since 2009.

- This is real estate, so there are big variations depending on location. The biggest drops in equity are in San Jose (24%), Seattle (21%) and San Francisco (20%).

- California accounted for more than half of the national decline in equity.

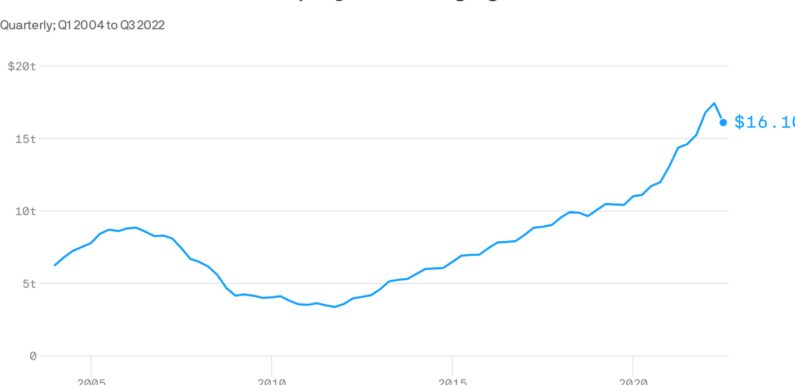

Reality check: Mortgage holders in the U.S. still have a lot more equity in their homes now than they did before the COVID-induced housing boom.

- The average borrower has, on paper, lost about $30,000 in equity from earlier this year, but still has $92,000 more than in February 2020.

- Unless you need to sell your house or borrow against it, its value is more of a vibe than a practical problem.

- Most homeowners are sitting on low-cost mortgages, with a large amount of equity.

- "If you close your eyes at the beginning of the pandemic and just kind of live there, and then look at [your home valuation today], I think you'd be very happy," says Andy Walden, vice president of enterprise research at Black Knight.

What to watch: Those that bought homes in 2021 or this year are most at risk of winding up "underwater" on their mortgage — owing more than their home is worth, Black Knight finds. That's a risky place, as those who recall the Great Recession know.

- That crop of recent buyers included a larger than typical number of Black and Latino borrowers, as Axios recently reported.

- And more home price declines are likely on the way, though Bachaud says that relatively low inventory will put a floor under those drops for now. "We're not going to see these steep price declines because we just don't have the inventory that would allow for something like that to happen."

Source: Read Full Article