Save articles for later

Add articles to your saved list and come back to them any time.

New and expanded taxes on vacant and undeveloped properties are expected to rake in up to $37 million a year, Victorian Treasurer Tim Pallas has revealed after he shocked the property industry with a new tax announcement on Tuesday morning.

The Allan government will expand its tax on vacant residential land to include all of Victoria, as well as properties that have been waiting to be developed for years, in new legislation to be introduced in state parliament.

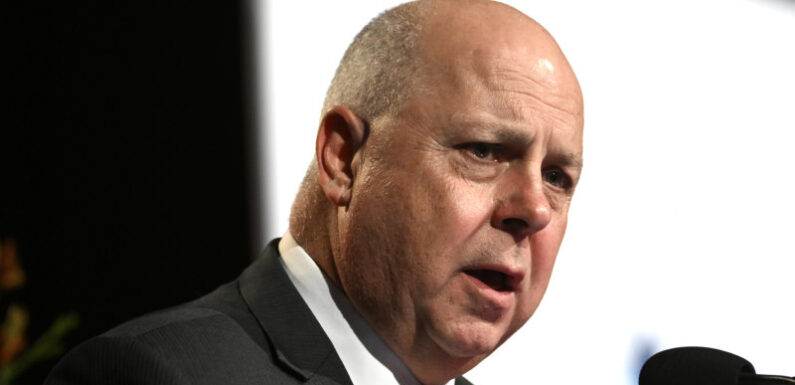

Treasurer Tim Pallas clarifies details of the expanded residential vacant land tax on Tuesday afternoon.Credit: Joe Armao

Homes that have been unoccupied for more than six months are currently only caught by the charge in Melbourne’s inner and middle-ring suburbs, but the tax will be expanded to include the whole state from January 1, 2025. Holiday homes are exempt.

Treasurer Tim Pallas announced the tax policy at a Property Council of Australia breakfast on Tuesday.

He said the government would also expand the tax to include land waiting to be developed, zoned as residential, that has been unimproved for more than five years in established Melbourne suburbs.

Owners can receive another two years if they have a building permit. The change will come into effect on January 1, 2026.

This was expected to collect $31 million in revenue a year, while the expanded vacant home charge will collect an additional $6 million.

Pallas said the unimproved land charges were aimed at substantial lots that were meant to be provided, in bulk, to the community.

“Land banking, that’s what we’re trying to knock out,” he said.

“We can’t afford really to have vacant land in metropolitan Melbourne sitting idle.

“Our clear message to the landowners is to either develop land or sell it to someone who will.

“Similarly, we’re not putting in place a rule for landowners that we as a state are not going to apply to ourselves.

“We expect every government agency that is holding land to justify exactly why are they holding that land and not putting it into the marketplace.”

The vacant residential land tax applies to inner and middle-ring Melbourne homes that have been unoccupied for more than six months in the past calendar year, and is charged at 1 per cent of the total value of the property, including buildings on site.

Pallas said the tax currently collected $10 million a year.

“Sometimes taxes are used to amend behaviour,” he said.

“It doesn’t massively advantage the budget. What it does is, it tries to send a message to people who have underutilised assets to think about utilising them, making them available, for people to move into as homes.

“We would much prefer not to get $1 out of tax that seeks to change behaviour. We’d prefer behaviour to change so that we can get people into homes.

“Of course the implementation of these arrangements have quite a long lead time as you’d appreciate. And we’ll work with industry to ensure that they are developed in the most effective way to amend behaviour without necessarily getting much in the way of revenue.”

The property industry was already raising concerns about the new tax, with further details to be clarified by the government later on Tuesday.

Shadow treasurer Brad Rowswell said Pallas, who on Monday was sworn into a new portfolio of economic growth, had introduced an increased tax as his first act in the role.

“Victoria is broke and Labor’s only plan for ‘economic growth’ is to tax Victorians more.”

Get alerts on significant breaking news as happens. Sign up for our Breaking News Alert.

Most Viewed in Politics

From our partners

Source: Read Full Article