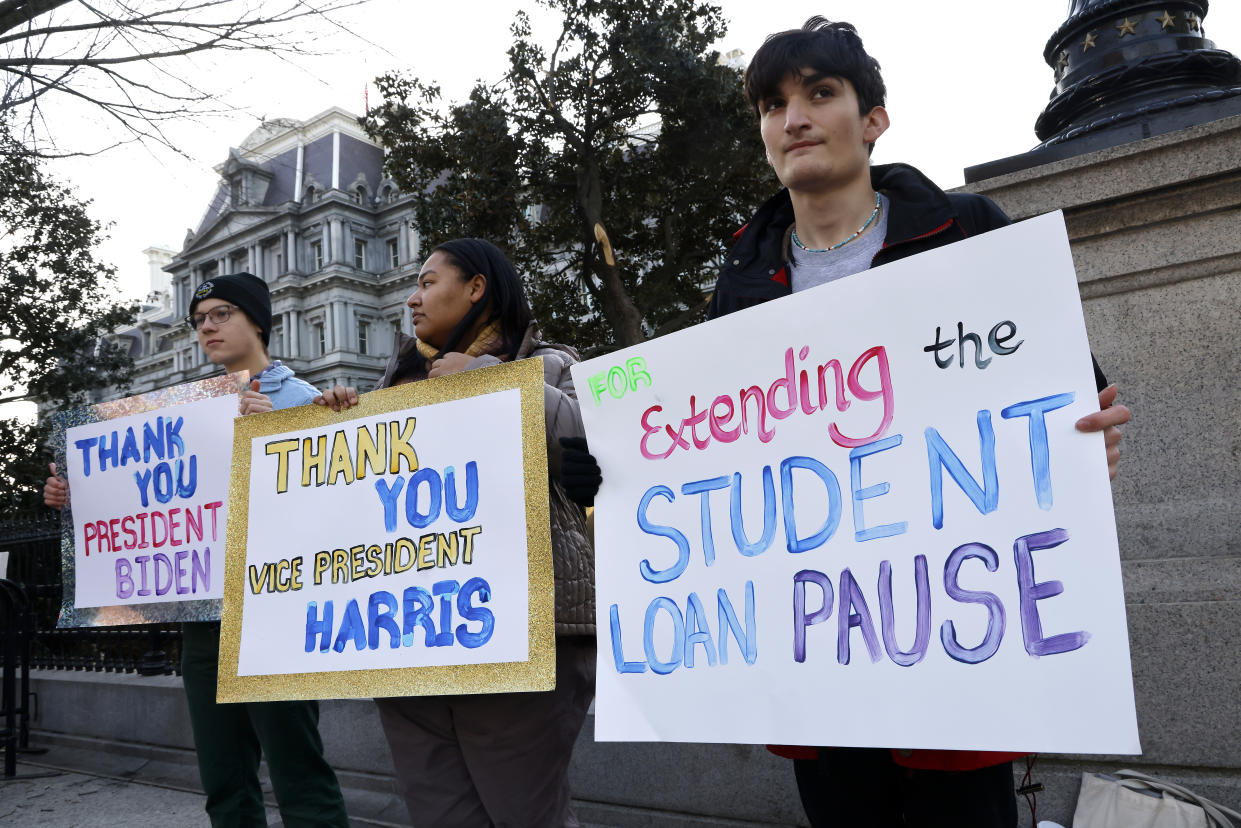

The countdown until the student loan payment pause is lifted in June is ticking, and some experts worry that once payments resume, many Americans may dig themselves deeper into credit card debt.

Already, credit card balances increased by $38 billion in the third quarter to $930 billion, the New York Federal Reserve found, with balances matching the pre-pandemic peak in the fourth quarter of 2019. Year over year, credit card debt grew by 15%, the largest jump in more than 20 years.

In six months — and with loan forgiveness still uncertain — millions of student borrowers will likely have to restart paying their loans every month and many may turn to credit cards to help with that loss of monthly cash flow.

“For millennials, there’s no question that the student loan moratorium has been a big deal and has allowed them to really knock down a lot of credit card debt,” Matt Schulz, chief credit analyst for LendingTree, told Yahoo Finance. “It’s definitely troubling to think what's going to happen to delinquency rates once everybody has to start making student loan payments again.”

Credit card delinquencies are on the rise

The pandemic gave millions of student loan borrowers some economic relief, which allowed many to pay down accumulated debts — like credit cards — and increase their savings. But that savings cushion is largely back to pre-pandemic levels, and higher prices and higher interest rates are putting pressure on budgets.

“I do think that we’re going to see some growth in credit debt overall. That’s just what happens in our country. The only time credit debt decreases is when there’s some major economic catastrophe; otherwise it will grow pretty consistently,” Schulz said. “There’s no reason to think that that’s going to change anytime soon.”

Delinquencies are expected to rise with debt levels.

According to TransUnion, serious credit card delinquencies are projected to increase to 2.60% at the end of 2023 from 2.10% at the end of 2022. Overall, card delinquency is expected to jump 20.3% year over year by the end of 2023 to levels not seen since 2010.

Already that’s showing up among the two youngest generations.

The share of millennials with credit card debt who are 60 days or more behind hit 5.0% in December, the Urban Institute found, followed by Gen Z at 4.5%. That compares with 3.5% for Gen X and 1.8% for baby boomers.

“It was easier to handle [credit card] debt during the pandemic because I didn’t have to worry about this [student loan] debt that was imposed upon me,” Maria Bermudez, a 30-year-old growth marketing manager who owes $12,000 in student loans and $5,000 in credit card debt, told Yahoo Finance.

Bermudez estimates she'll have to devote $400 of her budget to credit card and student debt payments when the student loan forbearance expires in June.

Young people living in communities of color are also more vulnerable to delinquencies, according to the Urban Institute. In December, the share of young adults living in communities of color with debt in collections was 24.8%, nearly 50 percentage points higher than young adults in majority-white communities with any debts in collections.

“With fewer financial resources such as incomes and assets, and barriers to public safety net programs, young adults may rely on credit cards to finance daily and emergency expenses,” the Urban Institute said in a report. “Young adults living in communities of color are more likely than their peers in majority-white communities to hold past-due credit card, auto/retail loan, and student debt.”

Look through your repayment options

Student loan borrowers should prepare now for when payments resume, and that includes making a plan to deal with any credit card debt they may already have.

“Fortunately there are a variety of ways for borrowers, particularly federal student loan borrowers, to resume payments in a way that allows them to prioritize those higher interest credit card debts and other types of debt,” Andrew Pentis, a certified counselor and higher education finance expert at Student Loan Hero, told Yahoo Finance.

“If a borrower is weighed down by credit card debt and they don’t have a lot of confidence in resuming or starting their federal student loan payments, they could request a deferment or forbearance,” Pentis said. “Better yet, they could opt for an income-driven repayment plan.”

A forbearance plan can pause payments temporarily, but interest will continue to accrue. With an income-driven repayment plan, borrowers can cap their monthly student loan payment at a percentage of their income.

“That can be hugely helpful for a borrower who might be smartly prioritizing larger payments on higher interest credit card debt," Pentis said.

What borrowers shouldn’t do is bet on another round of relief from the government.

“Don’t sit on your hands. Don’t wait for mass student loan forgiveness. Don’t wait for another extension of this moratorium,” Pentis said. “It’s really important to have a plan in place for your repayment. There is an end in sight if you have the time to research some of these options for your repayment.”

Gabriella is a personal finance reporter at Yahoo Finance. Follow her on Twitter @__gabriellacruz.

Click here for the latest economic news and economic indicators to help you in your investing decisions

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube.

Source: Read Full Article