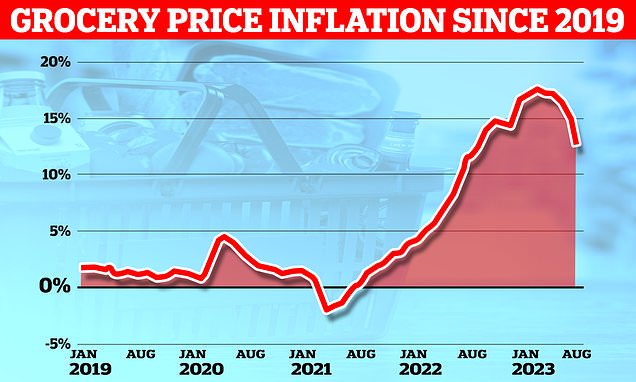

Grocery price inflation drops for fifth month in a row to 12.7% with prices of staple goods like milk and sunflower oil falling – but cash-strapped shoppers still face higher prices for eggs, sweets and frozen chips

- Kantar reports grocery price inflation rate fell to to 12.7% for four weeks to Aug 6

- Down from 14.9%, it was the second sharpest monthly drop since records began

Britain’s grocery price inflation rate has fallen for the fifth month in a row as experts reported the second sharpest monthly drop since records began 15 years ago.

Analysts at Kantar said price inflation across grocery shops was at 12.7 per cent for the four weeks to August 6, dropping from 14.9 per cent over the previous month.

It is the fifth consecutive decline in the rate since the figure peaked at 17.5 per cent in March – but shoppers still face higher prices across ‘every supermarket shelf’.

Kantar said prices have been rising fastest for eggs; ‘frozen potato products’ such as oven chips and wedges; and sweets under the ‘sugar confectionery’ category.

However the cost of milk has edged down compared with earlier this year – with shoppers paying £1.50 for four pints last month, down from £1.69 in March.

Experts added that 7.6million households bought groceries from Wilko over the past year – so retailers will be watching what happens after it fell into administration last week, putting the future of its 400 stores and 12,500 workers in jeopardy.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: ‘The latest slowdown in price rises is the second sharpest monthly fall since we started monitoring grocery inflation in this way back in 2008.

READ MORE Bidders in race to save Wilko are ‘REVEALED’ as B&M, Poundland and Home Bargains – while shoppers race to empty shelves after high street chain plunged into administration with potential buyers given just hours to secure a deal

‘Prices are still up year-on-year across every supermarket shelf, but consumers will have been relieved to see the cost of some staple goods starting to edge down compared with earlier in 2023.

‘Shoppers paid £1.50 for four pints of milk last month, down from £1.69 in March, while the average cost of a litre of sunflower oil is now £2.19, 22p less than in the spring.’

The data, based on the shopping habits of 30,000 households across the UK, also showed strong demand for own-label products from cash-conscious customers, with sales up by 9.7 per cent for the quarter.

Mr McKevitt said the average increase in households’ weekly grocery shop is £5.13 compared with last year.

But this is well below the £11.27 extra they would have paid if consumers had bought exactly the same items as 12 months ago based on the current inflation rate.

He added: ‘Own-label sales continue to outpace branded, although the gap between the two is closing. Buying supermarket lines is just one of the ways people have been trying to save money at the tills and we can see the impact on how much they are spending.

Overall take-home grocery sales increased by 6.5 per cent over the month, Kantar said, slipping from 10.4 per cent growth last month.

The experts said recent wet weather saw shoppers turn away from traditional summer favourites, while soup sales grew 16 per cent as people looked for warming meals.

Tesco still has by far the highest grocery market share at 27%, followed by Sainsbury’s at 14.8%

Mr McKevitt added: ‘It was a better month for Barbie than barbecues this July as the rain put a spanner in the works for many consumers’ outdoor plans – a stark comparison to last year when we experienced the hottest day on record.

READ MORE M&S shares soar as it reports strong sales and eyes profit growth as consumers prove resilient

‘Volume sales of ice creams were down by 30 per cent, while soft drinks sales were nearly a fifth lower than 12 months ago.’

The fresh data also shows that sales at Tesco and Sainsbury’s grew strongly over the 12 weeks to August 6, rising by 9.5 per cent and 9.3 per cent respectively.

Tesco boosted its market share to 27.0 per cent, from 26.9 per cent a year ago, and Sainsbury’s held year-on-year at 14.8 per cent.

Asda pushed its sales up by 7.7 per cent this month and now accounts for 13.7 per cent of the market, while Morrisons has an 8.7 per cent share as sales grew 2.3 per cent compared with last year.

Meanwhile, Aldi was the fastest growing retailer for the fourth month in a row, with its sales jumping by 21.2 per cent year-on-year. It now has a market share of 10.2 per cent, an annual rise of 1.1 percentage points.

Lidl’s sales rose by 19.8 per cent and the retailer now holds 7.7 per cent of the market.

Sales at Waitrose and Co-op rose by 4.4 per cent and 3.4 per cent, giving the retailers market shares of 4.4 per cent and 6.1 per cent respectively.

Iceland saw sales increase by 6.7 per cent to take a 2.3 per cent share, while Ocado’s share now stands at 1.7 per cent as spending grew by 1.4 per cent.

The experts added that overall footfall was down for the first time in 18 months with people making 320,000 fewer trips to physical supermarkets than a year ago.

It comes as bidders for Wilko have less than 48 hours to save the crisis-stricken retailer following its collapse. Administrators at PwC have set a deadline of the close of business tomorrow for a rescue deal to be struck in a bid to save jobs.

Rival discount chains including B&M and Home Bargains are among those thought to be interested in a deal.

And Mr McKevitt said: ‘Wilko is a popular choice for many shoppers with 7.6million households visiting its stores to buy groceries in the last year.

‘Grocery items make up just under half of its sales, with homeware at 15 per cent, DIY at 9 per cent and garden products at 7 per cent.

‘Wilko’s rivals will be keeping a close eye on its fortunes in the coming days and weeks as they look to draw some of its shoppers through their doors.’

Source: Read Full Article