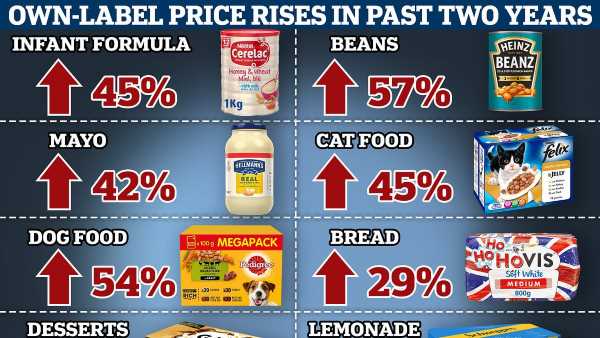

Is ‘greedflation’ fuelling the cost-of-living crisis? How prices of own-brand goods have surged in the past two years – with baby formula up 45%, beans 57% and cat food 65% – amid claims they’re being hiked

Suspicions of ‘greedflation’ are on the rise after it was revealed that prices of own-brand goods have surged in the past two years.

Among the biggest risers are baby formula, which has gone up by 45 per cent in the past two years; baked beans which has hiked up by 57 per cent and cat food, which has peaked to a 65 per cent increase.

In conjunction with big-brand manufacturers hiking their costs, the details, published today by the Competition and Markets Authority, suggest the companies producing the own-brand labels have no doubt contributed to the hike in inflation.

CMA research found that three in four big-brand manufacturers have raised shelf prices by more than their costs in the past two years. Brands in the dock include Heinz, Nestle and Mars Petcare, which makes Whiskas and Pedigree.

But though shoppers may wish to protect themselves by switching to own-label alternatives, the new data suggests this may not be so easy.

Own-brand milk is another product which has surged by 38 per cent in the past year. Mayonnaise, up 42 per cent, and dog food, up 54 per cent, are just two more examples.

Suspicions of ‘greedflation’ are on the rise after it was revealed that prices of own-brand goods have surged in the past two years

Among the biggest risers are baby formula, which has gone up by 45 per cent in the past two years

A specific concern of the watchdog is with regards to baby formula.

The high prices of baby milk brands, such as Aptamil and SMA, have become unaffordable for many low-income families with some resorting to shoplifting or watering them down, putting babies’ health at risk.

Some supermarkets are even putting formula packs inside tagged security cases.

But with own-brand labels also hiking their prices, customers could be left with little choice.

It said: ‘The prices for baby formula in the UK have risen by 25 per cent over the past two years. Evidence suggests that branded suppliers of baby formula have increased their prices by more than their input costs.

‘On top of this, the market is highly concentrated (two firms have around 85 per cent of the market share) and brands have maintained high profit margins over the last two years. There is little evidence of parents switching to cheaper branded options as prices have risen and very limited availability of own-brand alternatives.

‘Families could make significant savings of more than £500 over the first year of a baby’s life, through buying cheaper baby formula options.’

The watchdog is concerned that manufacturers may be taking advantage of a desire by parents to give babies the best start, which means buying an expensive big brand rather than a cheaper alternative.

While cheaper options provide all the nutrients a healthy baby needs, many parents do not understand this. Supermarkets have little incentive to cut prices as they are legally banned from promoting reductions because it could be seen as encouraging mothers to stop breastfeeding.

Concerns have also been raised as part of a wider study that found three in four big-brand manufacturers of groceries such as baked beans, mayonnaise, and pet food have increased prices by more than their costs.

The CMA also announced a further investigation into the market and the activities of the two dominant manufacturers; Danone, which owns Aptamil and Cow & Gate; and Nestle, which owns SMA.

The details, which were published today by the Competition and Markets Authority, will fuel suspicions of ‘greedflation’. (File image of baked beans which have risen the most)

The watchdog is concerned that manufacturers may be taking advantage of a desire by parents to give babies the best start, which means buying an expensive big brand rather than a cheaper alternative. (File image)

The CMA said: ‘Food price inflation continues to be at historically high levels, despite falling to 10.1 per cent in October 2023. Evidence collected by the CMA indicates that, over the last two years, around three quarters of branded suppliers in products such as infant formula, baked beans, mayonnaise, and pet food – have increased their unit profitability and, in doing so, have contributed to higher food price inflation.’

The CMA said it has heard that some leading brands are not planning to pass on future falls in costs through blanket reductions but will use targeted promotions instead.

Sue Davies, head of food policy at Which?, said: ‘The competition regulator’s findings that leading brands have raised their prices by more than their cost increases during the cost of living crisis will be shocking for many people who have been struggling to deal with food price inflation.’

The CMA’s chief executive, Sarah Cardell, said: ‘Food price inflation has put huge strain on household budgets, so it is vital competition issues aren’t adding to the problem.’

On baby formula, she said: ‘We’re concerned that parents may not always have the right information to make informed choices and that suppliers may not have strong incentives to offer infant formula at competitive prices.

‘We will investigate this further and consider whether changes to regulations are necessary to ensure parents can get the best deal possible.’

Looking at supermarkets, she said: ‘We have also seen an increase in the use of loyalty scheme pricing by supermarkets, which means that price promotions are only available to people who sign up for loyalty cards.’

Danone defended its prices saying: ‘We have worked very hard to absorb the significant cost increases we have faced, make savings, and minimise any price increases. In order to offer parents the best value, and to ensure we are as competitive in the market as possible, we have launched new larger, better value formats.’

The CMA said: ‘Food price inflation continues to be at historically high levels, despite falling to 10.1 per cent in October 2023.’ (file image of Felix cat food)

The Food and Drink Federation, which speaks for manufacturers, said rises had been ‘unavoidable’.

Chief executive Karen Betts added: ‘Food and drink manufacturers have been grappling with rising input costs since September 2020, and they have done all they can over the past three years to absorb these costs to shield shoppers from the full impact of inflation.

‘The huge rises in input costs we’ve seen have undoubtedly been very challenging – one shock would have been difficult, but the successive shocks of Covid 19, Brexit and the war in Ukraine, alongside droughts, wildfires and flooding in Europe in particular, have eroded our sector’s resilience significantly.’

The British Retail Consortium, which represents supermarkets, said the profit margin on own-label products has fallen from 4 per cent to less than 2 per cent since 2020.

Its director of food and sustainability, Andrew Opie, said: ‘While many branded manufacturers had increased their unit profitability during the cost of living crisis, savvy consumers have been trading down to supermarket own-label brands in order to get the best possible value.

‘Retailers will continue to deliver excellent value for their customers. However, this continues to be challenged by rising costs, from hundreds of millions in additional business rates to higher labour costs.’

The British Pregnancy Advisorty Service (BPAS) also condemned the price hikes on baby formula.

Its chief executive, Clare Murphy, said: ‘No woman should be priced out of choosing how to feed her baby.

‘The growing cost of formula is an area of huge concern and it is high time action was taken to address the needs of women and their families, many of whom are struggling to cope with the significant increases at a time when other costs have also risen.

‘It’s the only food, besides breastfeeding, that is suitable for a baby in infancy. For too long the needs of formula feeding families have been neglected on the basis that all efforts should be focused on the promotion of breastfeeding.’ Nestle said: ‘This is a complex and serious issue and we are open to all constructive dialogue to help parents in the most effective way possible.

‘Our goal has always been to keep products affordable and accessible for parents while still paying fair prices to our suppliers, including farmers. There have been significant increases in costs but we have been working to cut our costs wherever possible and only increase prices as a last resort.’

Source: Read Full Article