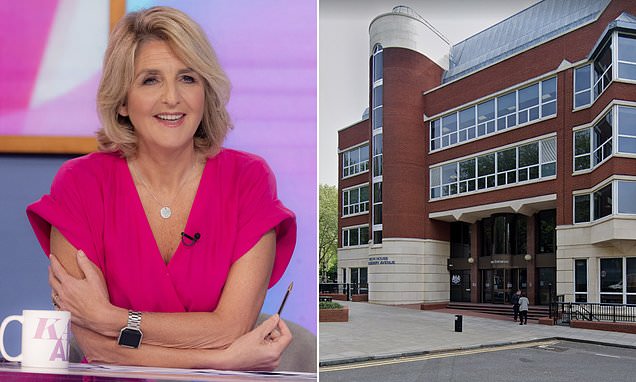

Loose Women star Kaye Adams has her case reheard in £124,000 dispute with the taxman that has rumbled on for four years

Kaye Adams began the re-hearing of her case against the HRMC today – a £124,000 tax battle which began over four years ago.

After winning her first case on the matter in 2019, the Loose Women star, 60, is once again being scrutinised for her work carried out between 2013 and 2017 – when hosting ‘The Kaye Adams Programme’ on BBC Radio Scotland.

HMRC believes the presenter, who was employed as a freelancer during that time via her company Atholl House Productions Ltd, owes £81,150.60 in income tax and £43,290.98 in national insurance contributions.

It comes as part of legislation known as IR35, designed to clampdown on tax avoidance by so-called ‘disguised employees’, who charge for their services via limited companies.

Meanwhile, Ms Adams claims she was in business in her own right and taking on other contracts at the time such as Loose Women and therefore not subject to the rules.

She was paid £155,000 per year to present a minimum of 160 programmes for the BBC.

She claims she was paid for Loose Women on a ‘show by show’ basis.

Kaye Adams will have her case reheard in a £124,000 tax battle with HMRC , a dispute which has lasted over four years

After winning her first case on the matter in 2019, the Loose Women star, 60, is once again being scrutinised for her work carried out between 2013 and 2017 – when hosting ‘The Kaye Adams Programme’ on BBC Radio Scotland

After winning her first case in 2019, significant weight was placed on the fact Ms Adams had been a freelance journalist for 20 years, was not financially dependent exclusively on the BBC, and was simply carrying on her profession as an independent provider of services.

And having her case re-heard two years later, an Upper Tribunal agreed once again with Adams in 2021, but HMRC appealed and a Court of Appeal judge ordered that the case be reconsidered in a lower tribunal.

Now, the tribunal must consider whether a hypothetical contract which reflected Ms Adams’ real work and obligations, rather than the real contract, would be treated as employment or self-employment.

Sitting at Taylor House in central London today, Judge Tony Beare asked whether the hearing ought to be adjourned until a decision in HMRC vs Professional Game Match Officials Ltd at the Supreme Court.

The case relates to the tax status of referees to the Football League and a decision may effect the law in Ms Adams’ case.

Keith Gordon, representing Atholl House Productions Ltd, argued it was open to the court to reconsider all the previous decisions made on the basis of the evidence it will hear today.

Adam Tolley, KC, for HMRC, argued the Court of Appeal had only directed a specific point around employment and self-employment be reconsidered.

He said that reconsidering everything would guarantee another appeal in the case and the case being remitted back to the lower tribunal again.

Mr Gordon said: ‘You might decide that even if the actual terms of the contract gave the BBC a lot of control there was never any likelihood of them being applied and therefore not put them in the hypothetical contact.’

He said the terms of the contract gave AHPL permission to send someone else as a replacement for Ms Adams with permission from the BBC, which was not be be ‘unreasonably withheld’.

‘If Ms Adams couldn’t make it one day and sent in Eamonn Holmes or Lorraine Kelly – there should be no question as to their suitability and the BBC would be forced to accept them,’ he said.

Judge Beare said: ‘I think this is very difficult – our aim is to minimise the cost associated with this process which has been going on way too long so we don’t want to have an adjournment and we also really don’t want to have another remittal to us.

‘I think we should proceed to hear the new evidence on the basis that the new evidence is capable of disrupting the earlier findings.’

He added that he was not making a ruling that the new evidence was capable of changing all of the earlier findings and said he did not think it did at this stage.

What are IR35 tax rules?

IR35 is the technical name for legislation introduced in 2000 that is meant to make it harder for contractors working as ‘disguised employees’ in order to pay less tax.

The rules see all contractors that do not meet HMRC’s definition of self-employment taxed at a similar rate to normal employees.

Officials define someone as self-employed if ‘most of the following are true’:

- They put in bids or give quotes to get work

- They are not under direct supervision when working

- They submit invoices for the work they’ve done

- They are responsible for paying their own National Insurance and tax

- They do not get holiday or sick pay when they’re not working

- They operate under a contract (sometimes known as a ‘contract for services’ or ‘consultancy agreement’) that uses terms like ‘self-employed’, ‘consultant’ or an ‘independent contractor’

This afternoon, the court heard from Jeff Zycinski, the Head of Radio at BBC Scotland from 2005 to 2018, who gave evidence via video link from his Inverness home.

Ms Adams sat behind her barrister in court wearing a white shirt and black jacket.

Mr Tolley said that from 2008 after a HMRC review the BBC began to require freelance presenters engaged in long term work to be hired through personal services companies, reducing the tax risk for the BBC.

Mr Zycinski said: ‘I was not aware it was a policy adopted because that kind of discussion was had between talent and my colleagues in contracts.

‘I know things were often quite messy at the BBC with rules rolled out in quite a haphazard fashion.’

He said that employing freelance presenters gave more flexibility to the radio station.

‘If audience figures changed necessitating a change of schedule you could do that with perhaps a month’s notice.

‘Even when time frames were agreed in contracts, presenters or the BBC may say another opportunity has emerged, or we’re making a change here, and then a civilised discussion is had about it.

‘Even six months is less notice than the way the BBC handles staff which is so heavily unionised the unions might demand up to 12 months notice.

‘Contracts were usually given out for a year and then you work on what the audience figures tell you within a year.

‘When I was offering a presenter a fee it was on the basis of what I could afford in terms of the total budget for the radio station.

‘That verbal agreement was reached then handed over to the contracts department.’

Mr Tolley told the hearing Ms Adams was paid £155,000 per year to present a minimum of 160 programmes for BBC Radio Scotland.

‘What is it about that contract that could be described as providing the “greatest flexibility”?’ he asked.

Mr Zycinski replied: ‘Because after that period of time there was no necessity for me to keep Kaye Adams on the station.

‘When you have a presenter and for whatever reasons they don’t perform or the format they’ve got don’t perform you can make a change.

‘Whereas if they’re on staff you can make a change but you’re still paying them on staff and have to find something else for them to do.’

Ms Adams would arrive at the BBC at 7am for briefing and leave after a debrief at 1pm, Mr Tolley said.

She would also do between 20 minutes and two hours preparation in the evenings.

Mr Tolley asked: ‘Do you accept in practice that would have prevented someone taking on another substantial presenting role simultaneously?’

Mr Zycinski replied: ‘No, I wouldn’t accept that, when you think about people in that role they’ll accept commitments that stretch into the evening, it’s not impossible to do other work.

‘Presenters realise they have a short shelf life so they’ll do as much work as they can when they are young and fit.

‘It’s not unheard of for people in this industry to work much more than what you and me would describe as office hours.’

Mr Zycinski said Ms Adams had first come to BBC Radio Scotland in 2010 to present a call-in programme called ‘Morning Call’ which became ‘Call Kaye’.

He said that market research had shown Ms Adams was a good option for the programme and he discussed this with bosses.

He added that not everyone at BBC Scotland was convinced Ms Adams was the best option but he believed she was.

‘Some people thought Lorraine Kelly was a bit too tabloid, a lot of people thought Kaye was a bit too Glasgow middle class- but at that time I wanted to sprinkle the schedule with well known names.’

From March 2015 the programme was extended to a three hour show to include interviews and current affairs discussion and renamed ‘The Kaye Adams Programme’.

‘We’d come out of the independence referendum and it had become clear during that period the audience had become more engaged in serious matters like health and education and that our morning schedule wasn’t best equipped to do that,’ Mr Zycinski said.

He said that the £155,000 figure was what he could afford from the budget at this time.

‘As much as I may have wanted Kaye all year round I realised we couldn’t afford that so this was basically my offer to Kaye.

‘My calculations assumed there’d be weeks she wouldn’t be doing it and we’d have a cheaper presenter.’

He said he wanted Ms Adams to present as many shows as possible in the first three months to establish the format before she would start to have more absences.

He said he was aware of the ill health of Ms Adams’ parents which led to her being able to do less work than she would like.

Mr Tolley asked if Mr Zycinski had been aware that Ms Adams was at that time expected to do a maximum of one show a week for Loose Women.

‘I knew she was back in favour with ITV and Loose Women so I expected that to be the case.

‘My point of view was I don’t know how long we can keep Kaye but I was very keen to ensure Kaye Adams stayed with us as long as she could.

‘I told her I understand Loose Women would come first because it’s television – and that’s great for us for profile.

‘I assumed she was back in favour with ITV and the way ITV works in particular is they have a roster of talent they deploy across the schedule especially in daytime and I assumed more work may be coming her way.’

Mr Zycinski said the BBC wouldn’t necessarily hold talent to what was written in contracts.

‘The thing about contracts in the BBC was the contracts were there in the background and what was more important was the personal relationship with the talent.

HMRC believes the presenter, who was employed as a freelancer during that time via her company Atholl House Productions Ltd, owes £81,150.60 in income tax and £43,290.98 in national insurance contributions

Earlier this year Gary Lineker won his dispute after he was told by the taxman he should have been classed as an employee of the BBC and BT Sport for his presenting duties, rather than a freelancer

‘The BBC knows it’s got to have something written down in case of trouble but there’s no point trying to hold talent to the letter of the contract if that’s going to make them unhappy.

‘There’s the contract and then there’s the reality of the relationship with the on air talent.

‘BBC Radio Scotland as much as it was important to me when I worked there is just small beer in terms of what’s going on in the media and the opportunities there for people.

‘You can either get in a huff about that or say this is fantastic – we’ve got Kaye for so many weeks a year.

‘The important thing was we had these names on the station and treating them with enough respect so they wanted to continue working with us.’

The hearing continues tomorrow.

In a similar case, Gary Lineker was accused of owing nearly £5million in unpaid tax under IR35 laws.

The Match Of The Day host won his battle against HMRC earlier this year, after he was told by the taxman he should have been classed as an employee of the BBC and BT Sport for his presenting duties, rather than as a freelancer.

The tax authorities pursued him for £4.9million, claiming should have been paid on income received between 2013 and 2018.

Throughout proceedings the presenter, 62, insisted all taxes were paid on the income via a partnership set up in 2012 with his ex-wife Danielle Bux. HMRC told MailOnline in March it was ‘considering’ an appeal.

The tribunal found that while Gary Lineker Media (GLM), which he set up with his then wife in 2012, was a partnership to which IR35 legislation applies, the appeal was still dismissed in full because contracts existed.

The judge said: ‘As a matter of law, when Mr Lineker signed the 2013 BBC Contract, the 2015 BBC Contract and the BT Sport Contract for the provision of his services, he did so as principal thereby contracting directly with the BBC and BT Sport.

‘As such, the intermediaries legislation cannot apply – it is only applicable ‘where services are provided not under a contract directly between client and the worker.

‘In this case Mr Lineker’s services were provided under direct contracts with the BBC and BT Sport.

‘Although such a conclusion might appear inconsistent with my conclusions that the intermediaries legislation can apply to partnerships… that is not the case.’

Source: Read Full Article