The volatility in the used car market rolled on in 2022, but there might be some relief for car buyers coming this year.

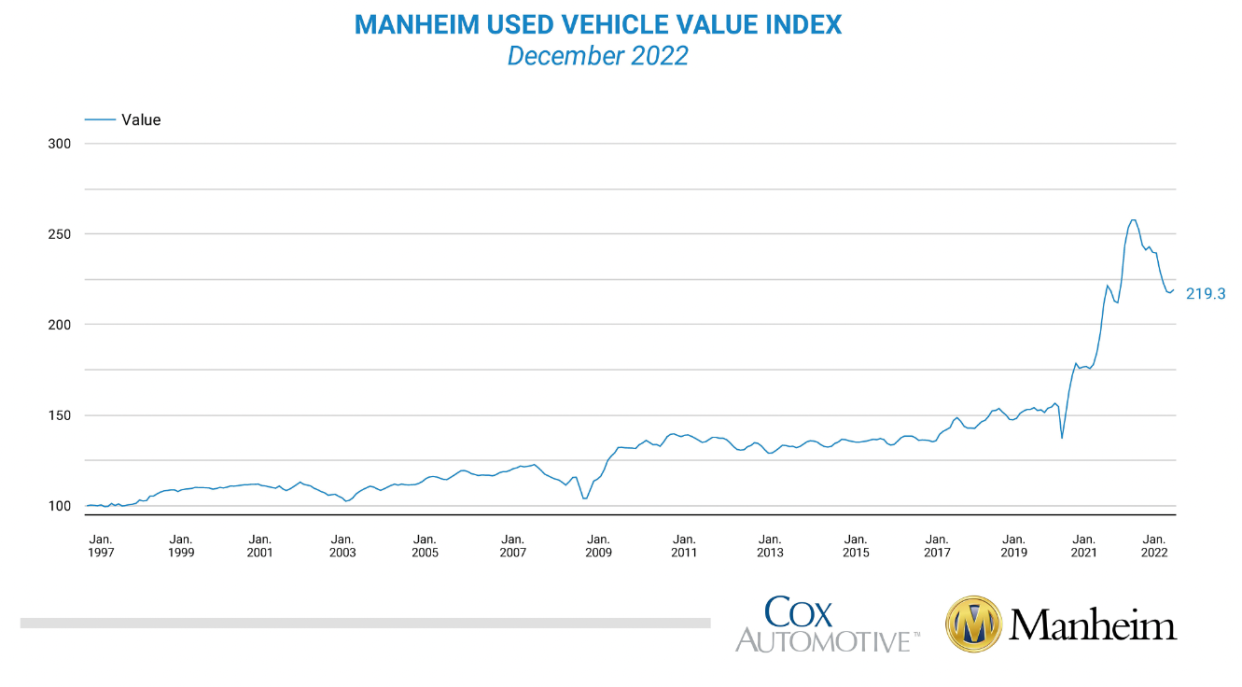

The Manheim Used Vehicle Value Index (MUVVI) for the month of December posted a 0.8% increase in wholesale auto prices month over month, however it dropped a whopping 14.9% year over year, the largest annualized price decline ever in the 26-year history of the index.

That being said, December’s index rating of 219.3 is still much higher than pre-pandemic levels, when the 2019 average index rating came in at 151.5.

"It's undeniable that 2022 culminates with unprecedented declines in the MUVVI, but it's important to look at the bigger picture," said Jonathan Smoke, Cox Automotive’s chief economist. "These last three years have been extremely volatile for the market, and these declines follow record increases. In December 2021, we were up 47% year over year. The pre-pandemic levels will likely never return, but all indicators point to reaching equilibrium in the second half of 2023."

That equilibrium could be taking place at the dealer level. Using Dealertrack data, Cox Automotive analysts found that same-store sales at used car dealerships fell 7% in December month over month and down 10% year over year, which is similar to what Cox saw in November.

On the flipside, new car sales continue to rebound. Dealertrack Data shows new light vehicle sales in December climbed 4.9% year over year, and by volume were up 12.2% from November.

Luxury sales boom

In fact, sticking to a trend seen earlier in 2022, new car sales at the highest end of the market seem strongest of all. Germany’s BMW (BMW.DE) retained its title as the No. 1 brand in the global premium market, besting its rival Mercedes-Benz. While both brands saw sales decline year over year due to shutdowns and the impact from the Russian war in Ukraine, they both saw strong sales increases in Q4, suggesting a return to normalcy and growth.

Stepping up to the ultra-luxury end of the market, Lamborghini revealed it sold a record 9,233 cars in 2022, a jump of 10% from the prior year. Asia and the Americas showed the biggest gains in terms of sales of growth for the Italian supercar brand. Sales were powered by its Urus “super SUV,” which topped 5,300 deliveries globally. Lamborghini CEO Stephan Winkelmann, who earlier this year said luxury demand was insatiable, said the company had to “carefully and meticulously manage” its future order intake to maintain a controlled level of growth and exclusivity.

In the U.K., Lamborghini’s corporate cousin under the VW (VOW.DE) umbrella, Bentley, delivered a record 15,174 vehicles across all its sales territories, a jump of 4% versus 2021.

“In what was another year of unpredictability, the business overcame significant headwinds and demonstrated great resilience to deliver the third consecutive year of record sales,” Bentley Chairman and CEO Adrian Hallmark said in a statement.

Hallmark told Yahoo Finance earlier this year that he had “never seen spending patterns” like this with the luxury consumer.

Bentley’s big domestic rival, Rolls-Royce Motorcars, also reported a record 2022, topping the 6,000-vehicle delivery mark for the first time.

“I think even more important than volume is probably the price position we achieved worldwide,” said Torsten Müller-Ötvös, Rolls-Royce Motorcars' CEO in an interview with Yahoo Finance. “On average, half a million [dollars] a Rolls-Royce goes now for, and that is quite an achievement. That was 10 years ago on $250,000, so quite a substantial higher positioning of the brand.”

Wall Street is getting on board the high end luxury trade as well, with Bank of America adding Ferrari (RACE) to its best auto ideas list in 2023.

Bank of America analysts cited factors such as modest volume expansion, an upward bias on pricing, licensing opportunities, and a commitment to preserving the “exclusive luxury culture” (i.e., controlling production volumes) as “upside risks” for the stock going forward.

—

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Source: Read Full Article